What Is a Payroll Summary Report?

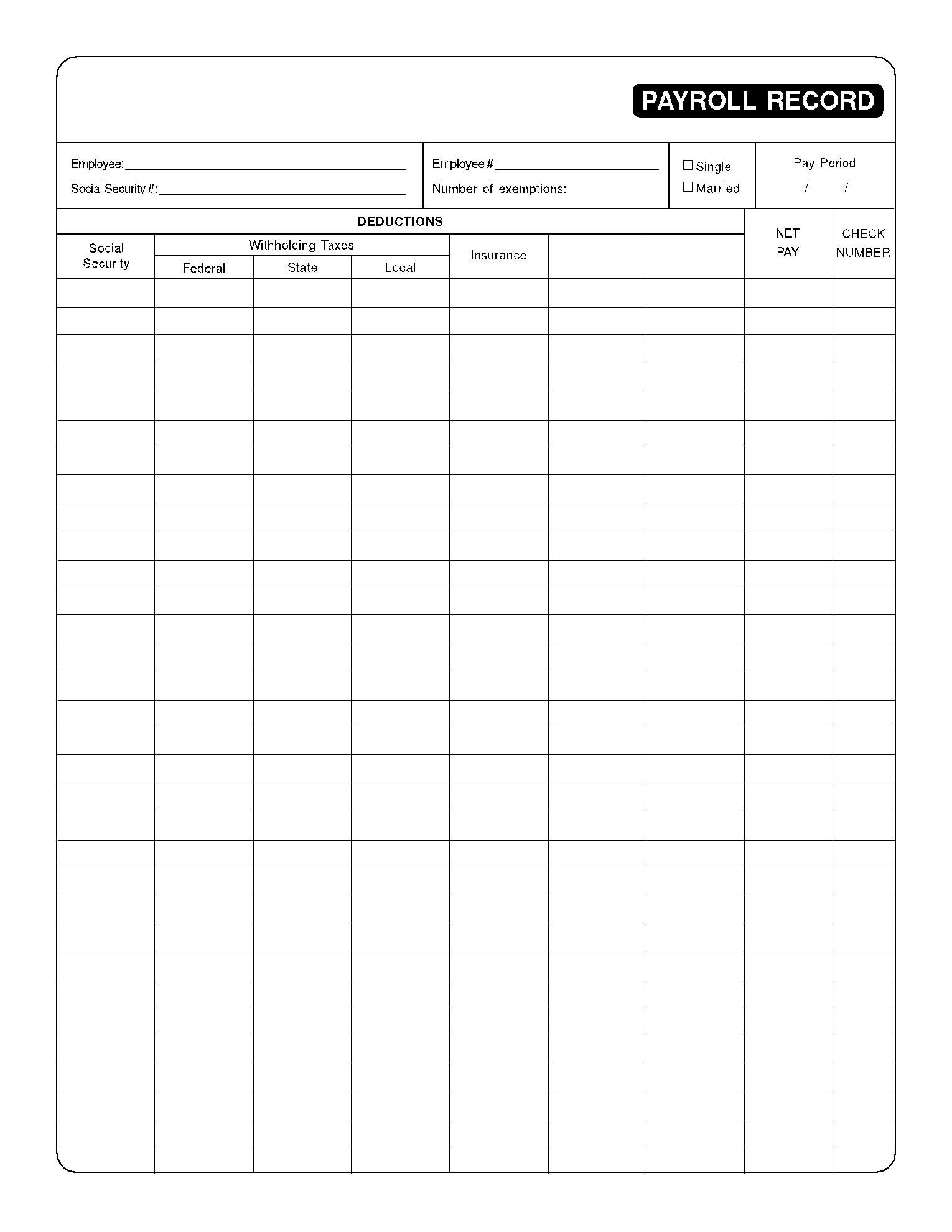

A payroll summary report is a statement that is used by employers or organizations to report the financial obligations to every employee. This document generally includes the employee payroll information like pay rates, tax deductions, insurance deductions, tax contribution by the employer, net pay details, etc.

The payroll summary report is helpful for small businesses and employers to get an overall insight into the payroll activity of their employees in a given time period. It helps them to estimate and manage workforce costs effectively. Most businesses need to file tax reports and some periodic forms with the governments.

In such cases, payroll summary reports enable the administration to verify the accuracy of the details filled in the forms by checking with the organized payroll information in the reports.

What Is Included in the Payroll Summary Report?

The payroll summary report includes the payment information of a single employee. Sometimes, you can also use it to record payment details of an individual unit or the complete workforce.

Either way, below are the details included in a payroll summary report template.

- Employee details - When the payroll summary report is used to depict individual employee pay details, each report has dedicated information about the employee. This includes their name, employee number, marital status of the employee, and such details.

- Payroll period - The period of time for which the information payment is included.

- Withholding taxes - The details of the tax amount that is deducted from the employee salary by the employer. This amount will be directly paid by the employer to the government on behalf of the employee. It includes details of the amount payable to the federal, state as well as local governments.

- Insurance - In the case of insurance benefits being covered by the employer, the cost deducted for the insurance coverage is included in this section.

- Net pay - The final amount to be paid to the employee is calculated and listed here after all the deductions.

- Check details - The information about the mode of payment and the check number is mentioned here.

Payroll Summary Report Filling Instructions

The payroll summary report template available at CocoDoc makes it very easy for you to fill in the payroll details of your employees. Below is a step-by-step guide to help you use the payroll summary report template effectively.

Step 1 - Download the payroll summary report template PDF available on this page.

Step 2 - Use CocoDoc online PDF filler to fill in the employee details like name, employee number, and marital status.

Step 3 - Fill in the period of payroll data to be included in the document.

Step 4 - Record all the payment details like the employee salary, withholdings, net pay.

Step 5 - Fill in the check number.

Step 6 - Once done, download the file or share it online with the concerned people.

What Is a Payroll Summary Report Used For and Who needs it?

A payroll summary report gives an employer a complete overview of the labor costs including tax withholdings, insurance deductions, net pay, and so on. The report template download available here can be used to record the payroll activity in an organized way.

The completed payroll summary report can be used to calculate and plan a business's expenses. It is also needed to submit the income and expense information to the government for tax filing purposes. Not all businesses can have a dedicated payroll management system for handling all the payroll activity. It is extremely difficult and costly for small-scale businesses.

The other options for these employers would be to hire an accountant to help with these tax management tasks or follow a self-handling approach by using various tools and templates. In such cases, this payroll summary report template is greatly helpful for accountants or businesses to record and keep track of all the payroll-related information in one place.